Summary:

- The OG chain continues to lead the non fungible token pack.

- ETH’s blockchain crossed $25 billion in NFT sales for all time at the end of May.

- The landmark moment solidified Ethereum’s position above competitors like Ronin and Solana.

- The mammoth network also achieved the feat despite dwindling NFT trading volumes and the cooldown in the crypto market.

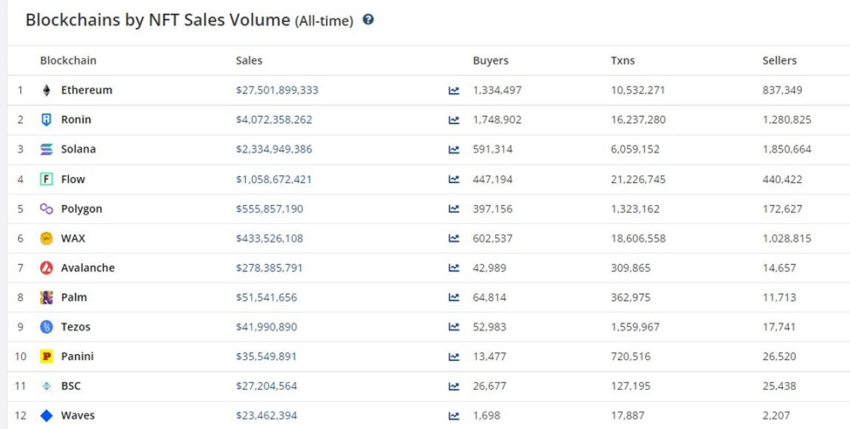

Ethereum has eclipsed previous records for all-time non fungible token (NFT) sales and established dominance in the NFT industry after clocking over $27 billion in sales by the end of May 2022.

Data from the on-chain NFT aggregator CryptoSlam showed that the blockchain is by far the preferred home for digital collectible sales as of press time. OpenSea, LooksRare, Rarible, and Foundation are a few marketplaces providing support for NFT trading on ETH’s blockchain.

The record solidifies Ethereum’s position at the peak of the NFT industry. The numbers available from CryptoSlam reveal that the blockchain is currently at least $20 billion ahead of competitors like Ronin, Solana, Flow, Polygon, Wax, and Avalanche in terms of sales volume.

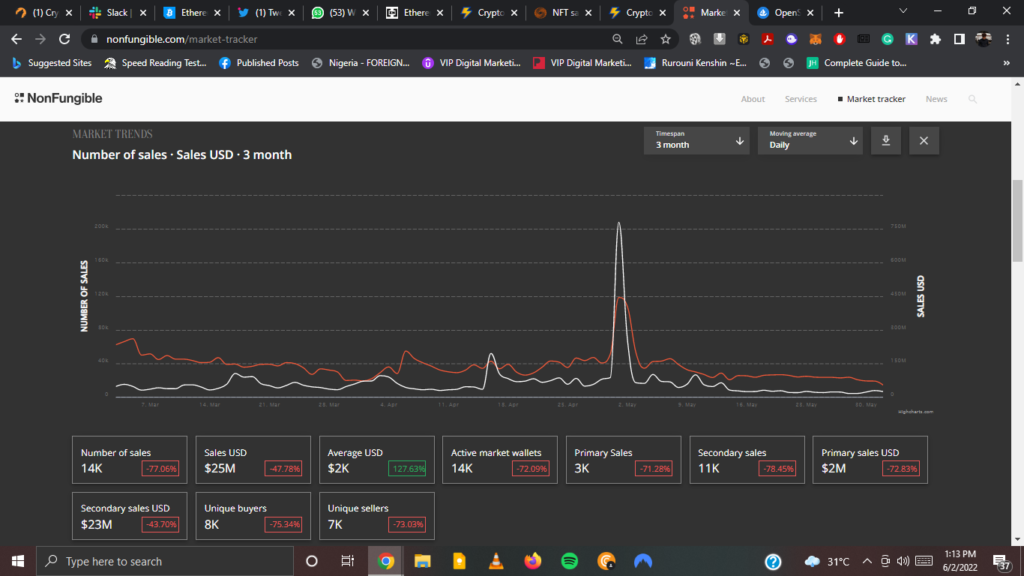

Notably, ETH’s chain crossed the $25 billion mark despite a drop in NFT sales over the past 90 days. According to nonfungible.com, sales dipped by over 77% in the last three months alone.

Ethereum’s NFT Dominance

Ethereum is the largest blockchain in the crypto ecosystem and decentralized finance across a plethora of metrics. The giant network is also one of the oldest networks in the decentralized space.

Also, the network co-founded by Vitalik Buterin in 2015 is home to one of the oldest and most notable NFT collections in the history of the industry – Crypto Punks. The OG collection launched by Larva Labs in 2017 arguably kicked off the digital collectibles wave that has now grown into a multi-billion dollar industry.

Ethereum is also known for housing several high-profile NFT projects and collections like Bored Apes Yacht Club, Cool Cats, Azuki, Moonbirds, World of Women, and Cyber Kongz to name a few.

These collections as well as others have garnered massive popularity both within the crypto ecosystem and mainstream space.

Creators and collectors also supposedly opt for Buterin’s blockchain due to the industry-leading security it offers. However, high transaction fees and network congestion have emerged as critical issues for traders.

The recently concluded BAYC Otherside metaverse mint is a testament to this. Regardless, Ethereum remains a top choice for NFT creators and collectors interested in ape into the world of digital collectibles.