- Former Bitmex CEO Arthur Hayes expects a significant increase if the Merge is successful; therefore, he is not planning a “sell the news” event.

- In the most recent writings on his Medium Blog, “Eth-Flexive” and “Max Bidding,” Arthur Hayes argues that Ethereum will have a rally similar to Bitcoin’s halving, based on current network usage.

Former Bitmex CEO Arthur Hayes, who previously claimed that he would be buying Bitcoin at $20,000 and Ethereum at $1,300, now reports that he is max bidding on Ethereum at current prices. In his most recent blog post, “Eth-Flexive,” Arthur Hayes confirms that he expects a significant increase in Ethereum’s price should the Merge be successful. He also stated that the “buy the rumor, sell the news” phenomenon will not occur post-merge. According to Hayes, anyone who might sell their crypto has already sold, and this is due to intense price movement downwards over the past month.

Inspired By George Soros’s “Theory of Reflexivity”

Arthur’s most recent blog post is centered around George Soros’s “Theory of Reflexivity,” taken from the book “Alchemy of Finance,” which is based on the idea that there is a feedback loop between market participants and market prices. In simpler terms, the theory explains that market participants often play a significant role in bringing about the future they speculate on, creating a self-fulfilling prophecy.

The Spot Market

Hayes describes the spot market’s current opinion on the Merge in further detail by looking into the ETH/BTC chart. As Ethereum is outperforming BTC and has been outperforming by 50% since the last crypto credit unwind, Hayes confirms that the market’s belief of a successful merge is growing more.

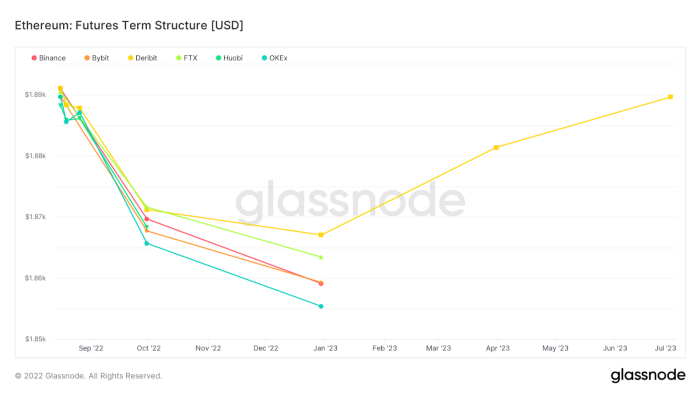

The Futures Market

The futures chart, on the other hand, illustrates a slightly different story. The entire curve out to June 2023 on the Open Futures Interest is trading in backwardation, which means that the market is predicting ETH’s price by the maturity date will be lower than the current spot price. This could be because market participants are using ETH futures as a hedge to their long spot exposure on Ethereum.

Merge Scenario Predictions According to Hayes

Iff the Merge occurs, according to Hayes, his prediction is as below:

“If the Merge is successful, there is a positive reflexive relationship between the price and the amount of currency deflation. Therefore, traders will buy ETH today, knowing that the higher the price goes, the more the network will be used and the more deflationary it will become, driving the price higher, causing the network to be used more, and so on and so forth. This is a virtuous circle for bulls. The ceiling is when all of humanity has an Ethereum wallet address.”

If the Merge does not occur on the other hand:

“If the merge is not successful, there will be a negatively reflexive relationship between the price and the amount of currency deflation. Or, to put it another way, there will be a positively reflexive relationship between the price and the amount of currency inflation. Therefore, in this scenario, I believe traders will either go short or choose not to own ETH.”

What Will Happen Post-Merge?

Ethereum’s Merge Date has been discussed by the core developer team and should occur before the end of September. The Ethereum merge is one of the most anticipated events in Ethereum’s history. Once the move from Proof of Work to Proof of Stake is achieved, Ethereum should undergo the following scenarios:

- Ethereum will undergo a 90% cut in daily emissions

- Yearly inflation will go down from 4.3% to 0.43%, equivalent to three Bitcoin Halvenings occurring at once

- Proof of Stake Validator rewards will go up from 4.5% to 10-15% in the months after the Merge

- Energy Consumption will drop by 99.9%.

Arthur Hayes states that he believes DeFi will offer a credible alternative to the current financial system as Ethereum becomes a deflationary currency, its usage increases, and DeFi gains popularity, which should increase the deflation rate further.

Arthur Hayes confirms that he will not reduce his position going into or right after the Merge; if anything if the market sells off before the Merge, he will be adding into his Ethereum position.