Summary:

- Apecoin (APE) continues to break records in the crypto markets

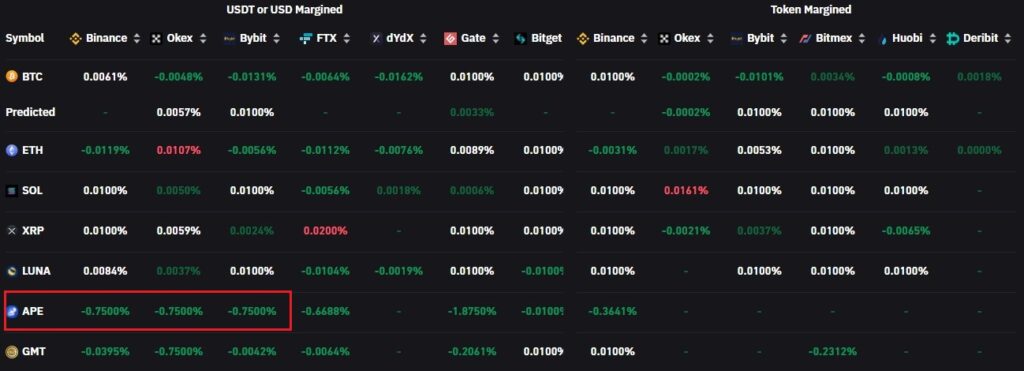

- The funding rate of Apecoin perpetual contracts has reached the maximum lower limit of -0.75%

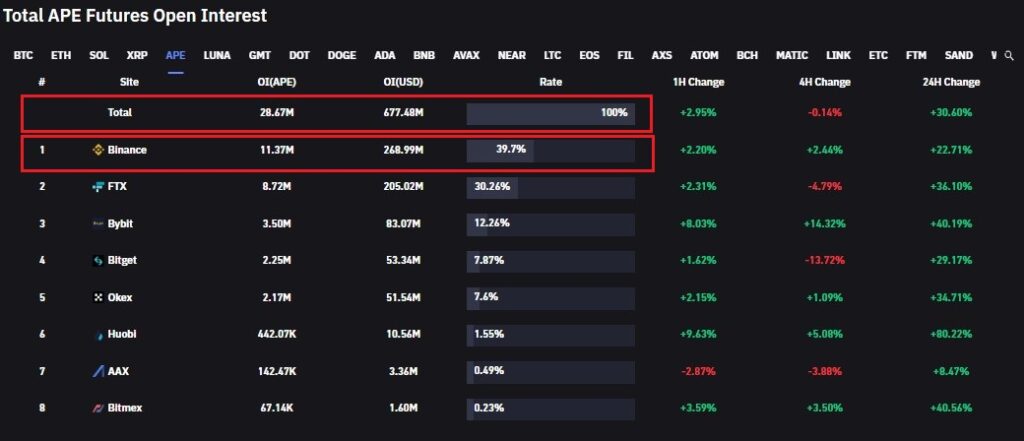

- Open interest on Apecoin futures contracts has reached $677 million

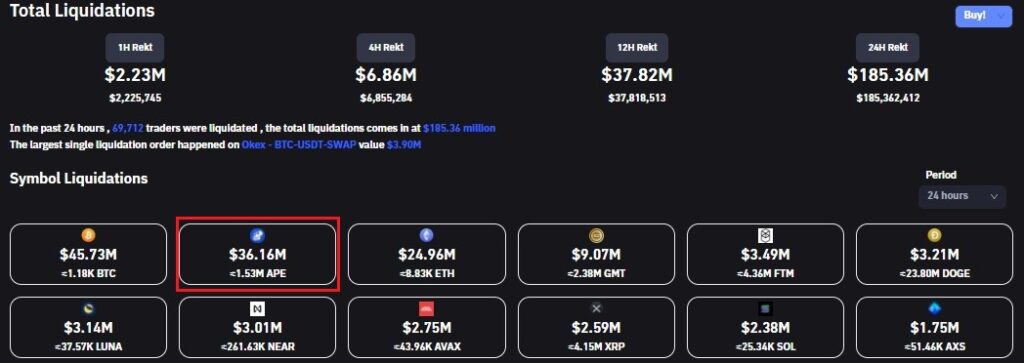

- Apecoin is the second-most liquidated asset in the last 24 hours

- The increased trade volume surrounding Apecoin (APE) is due to the launch of the Otherside Metaverse today, April 30th

The native token of the Bored Ape Yacht Club ecosystem, Apecoin (APE), continues on its path of breaking records. At the time of writing, funding on Apecoin’s perpetual contracts has reached the maximum lower limit of -0.75%. A negative funding rate means that short sellers outnumber the bulls. In this scenario, the short-sellers are paying for long positions.

Apecoin Futures Open Interest hits $677.48M with $268.99M on Binance

Furthermore, the total open interest on Apecoin futures contracts has reached a new peak value of $677.48 million, with $268.99 million being on the Binance platform alone. This amount represents 39.7% of Apecoin’s holdings on the platform.

Apecoin is the Second Most Liquidated Asset in the Last 24 hours

Moreover, Apecoin has eclipsed Ethereum to become the second most liquidated asset in the last 24hours. At the time of writing, $36.16 million in Apecoin has been liquidated compared to Bitcoin’s $45.73 million and Ethereum’s $24.96 million in the stated period.

Apecoin Shines as the Bored Ape Yacht Club Metaverse of Otherside Launches

The increased interest and trade activity surrounding Apecoin (APE) is due to the launch of the Otherside Metaverse today, April 30th, at 9 am ET. The Otherside team has announced that mints on the metaverse will not follow the traditional Dutch auctions (the most commonly known price bidding where the owner of the highest bid wins the sale).

However, the cost to mint an Otherdeed NFT for a plot of land will be a flat rate of 305 Apecoin (APE).

The team explained the process as follows.

NFT “Dutch auctions” are actually bullshit. They do not successfully mediate demand, nor do they really negate gas wars in highly-anticipated mints…

So actually, f*ck doing a Dutch auction.

The cost to mint an Otherdeed NFT will be a flat price of 305 ApeCoin. A total of 55k Otherdeeds will be available for purchase by KYC’d wallets. In order to ensure as broad a distribution as possible and dramatically soften the potential for a massive gas war, there will be an enforced limit of 2 NFTs per wallet at the start of the sale. Again, this is per wallet, not per transaction.

This, in turn, explains the demand for Apecoin in the crypto markets.